The Corporate Transparency Act

The Corporate Transparency Act, commonly known as the CTA, was enacted by Congress to further corporate transparency by identifying the people behind companies. It aims to fight against a spectrum of financial crimes. Such crimes include money laundering, terrorist financing, tax evasion, and other misuse and abuse. Its core mechanism involves the establishment of a comprehensive national database to clarify the individuals associated with corporate entities.

Beneficial Ownership Information Report

The CTA mandates some entities to submit a detailed Beneficial Ownership Information Report (BOIR) to the Financial Crimes Enforcement Network (FinCEN), a bureau within the U.S. Department of Treasury. Your company may be a reporting company and need to report information about its beneficial owners if your company is:

- A corporation, a limited liability company (LLC), or was otherwise created in the United States by filing a document with a secretary of state or any similar office under the law of a state or Indian tribe.

- A foreign company and was registered to do business in any U.S. state or Indian tribe by such a filing.

Under the Corporate Transparency Act, business entities must disclose specific company details to FinCEN, including the company’s legal name, business address, the jurisdiction where the business was formed, and tax identification number. Further, the company will disclose details concerning its beneficial owners. These individuals hold at least 25 percent ownership interest over the company. Such information include legal name, date of birth, address, and unique identification number.

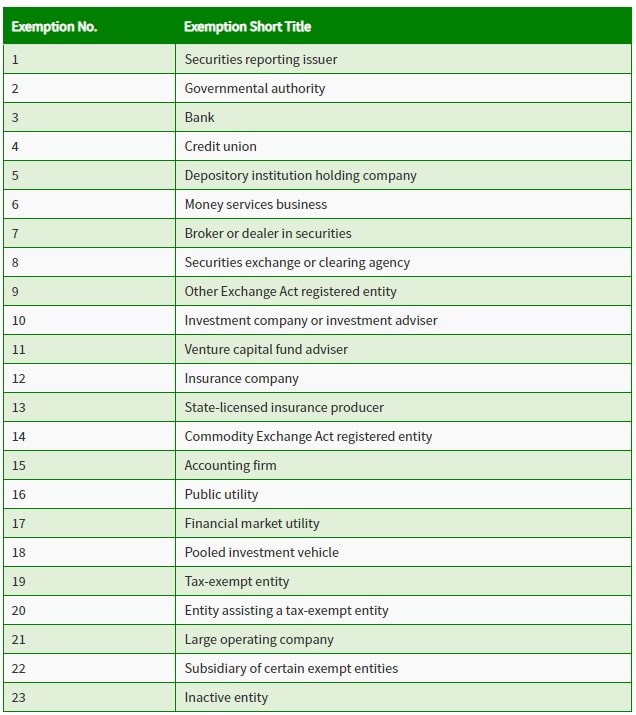

Exemptions

Twenty-three categories of entities are excluded from the obligation to report beneficial ownership information. These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

How to Report

Reports will be accepted starting on January 1, 2024. Reporting companies must report beneficial ownership information through FinCEN’s website: www.fincen.gov/boi.

When to Report

If your company was created or registered before January 1, 2024, you will have until January 1, 2025, to report BOI. If your company was created or registered on or after January 1, 2024, and before January 1, 2025, you must report BOI within 90 calendar days after receiving notice that your company’s creation or registration is effective, whichever is earlier. Lastly, suppose your company was created or registered on or after January 1, 2025. In that case, you must file BOI within 30 calendar days after receiving notice of its creation. Importantly, you must submit any updates to beneficial ownership within 30 days of the update.

Concerned about the impact of The Corporate Transparency Act on your business? Contact us today to delve deeper into what this crucial legislation means for you!