The 2024 Crypto Halving Event and What It Means for Investors

Cryptocurrency has garnered significant media attention in the last few years. This is especially true after cryptocurrencies experience large price increases, as has occurred several times over the last ten years. For Bitcoin, the most widely used and recognized cryptocurrency, a key event called halving is fast approaching. Crypto halving refers to when the reward for mining Bitcoin is cut in half. This happens approximately every four years. The last halving took place in 2020, and the next is expected to occur in April of 2024. As accountants who love to clarify and simplify financial transactions for our clients, we here at MyCPA wanted to write about this event.

What is Cryptocurrency and Bitcoin?

Cryptocurrency, or crypto for short, is digital money not issued or managed by any central authority. Instead, it is created through a network of computers. For this reason, crypto is often referred to as decentralized. All crypto ownership and transfer information is maintained on a distributed digital ledger protected by strong cryptography and referred to as the blockchain. In this distributed system, ledgers are maintained by “miners,” or parties that validate transactions.

In 2009, the first cryptocurrency, called Bitcoin, was released. Today, there are over 25,000 cryptocurrencies. Despite its name, crypto is not considered a traditional currency. It is perceived to have several benefits over traditional currencies, however. These benefits include:

- Privacy – No personal information is exchanged when purchases are made with crypto, and no central authority oversees the transactions.

- Global use – Cryptocurrencies are used globally, so there is no foreign exchange rate risk.

Mining and Halving Events

Mining is the process of validating crypto transactions and creating new crypto. In the case of Bitcoin, a “block” is a file that contains 1 megabyte of Bitcoin transaction records. Miners compete by using heavy computing power to solve complex mathematical problems and validate a block. In exchange for completing a block, they receive a certain amount of Bitcoin. When Bitcoin was first introduced, miners were paid 50 Bitcoin per block.

Part of the protocol for Bitcoin includes pre-programed halving events, at which time the amount of Bitcoin paid for each new block is decreased in half. A halving occurs every 210,000 blocks mined. Historically, this happens about every four years. In 2012, 2015, and 2020, crypto halving events took place, and the reward for mining Bitcoin decreased to 25 BTC, 12.5 BTC, and 6.25 BTC, respectively.

Halving serves several purposes. It controls supply by reducing the reward for mining and, thus, the rate at which new coins are created. From an economic standpoint, when the supply of goods decreases while demand remains constant, the price of such goods tends to rise. Halvings reduce the financial incentive to mine Bitcoin, and as a result, the supply declines. The resulting scarcity has historically been followed by upward price movement for Bitcoin.

Halving events also increases the predictability of the supply of Bitcoin. Eventually, miners are expected to shift away from creating new Bitcoin and instead make money from transaction fees.

Impact of Halving on the Crypto Market

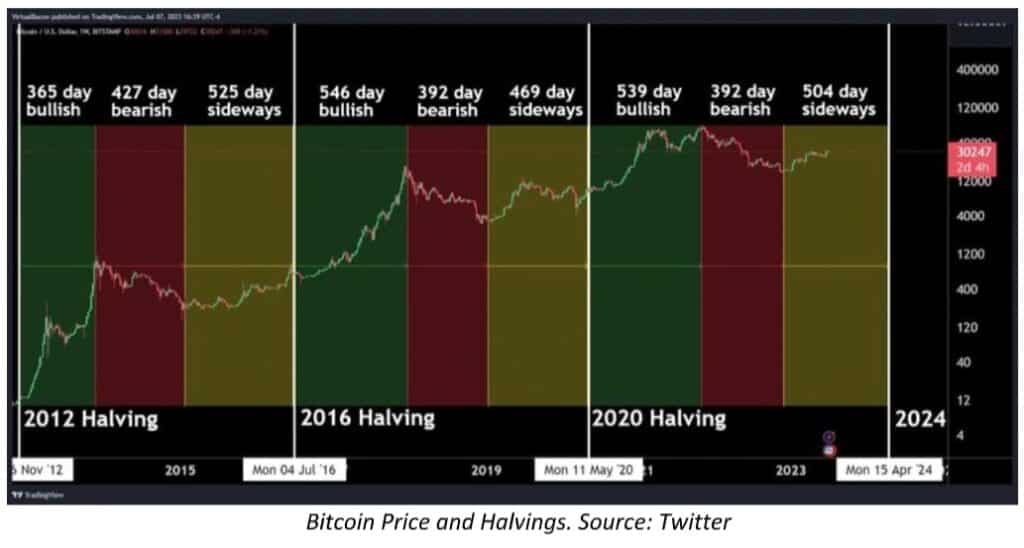

Past halving events have been followed by significant price increases for Bitcoin. After the 2012 halving, the price of Bitcoin increased steadily over the next year. After the 2016 and 2020 crypto halving events, the price increased steadily over the next year and a half. Each increase was followed by a slow and steady decline over the subsequent year, followed by a year and a half of fairly flat price.

Of course, the crypto market is complex and influenced by a number of factors, so it is difficult to isolate and quantify the specific impact of halving on these price movements.

Aside from the economic impact of decreased supply, halving events have brought greater attention and press coverage to cryptocurrencies and Bitcoin. Positive market sentiment also often results from investors’ expectation that prices will increase. While historical performance is not indicative of future results, patterns such as this one can help inform an investor’s strategy.

Other Factors to Consider

- Market Volatility: Crypto markets have historically been much more volatile than the stock market, and halving events have historically been followed by increased price volatility. This can mean greater return but also greater loss. Investors should be prepared for both upward and downward market fluctuations and consider risk management strategies to protect their portfolios.

- Diversification: Part of any good risk management strategy includes diversifying investments. Investors should align their overall portfolios with their risk tolerance. This might include matching the increased volatility of crypto with other more secure investments to help mitigate potential losses.

The Bottom Line

The upcoming Bitcoin halving is considered a unique event in the crypto space, which may provide opportunities for investors. We believe investors should have a comprehensive understanding of the risks and rewards of investing in crypto. The relationship between halving events and price movements is not guaranteed, and various factors can simultaneously influence the market in different ways. The crypto market has evolved since the prior halving events as well, which means the reaction may also change. By staying informed, consulting with professionals, and implementing a risk management strategy, investors can navigate the crypto landscape with greater clarity.