Beneficial Ownership Information Reporting – What You Need to Know

Deadlines, Penalties & Requirements of the Beneficial Ownership Information Report

The Corporate Transparency Act, commonly known as the CTA, was enacted by Congress to further corporate transparency by identifying the people behind companies. For this reason, companies are now required to report information to FinCEN about the individuals who ultimately own or control them in a beneficial ownership information (BOI) report. FinCEN began accepting reports on January 1, 2024. Use the links below to navigate this page:

- Beneficial Owners Defined

- Company Applicants Defined

- Reporting Obligations

- Frequently Asked Questions & Links

- Useful links from FinCEN’s website:

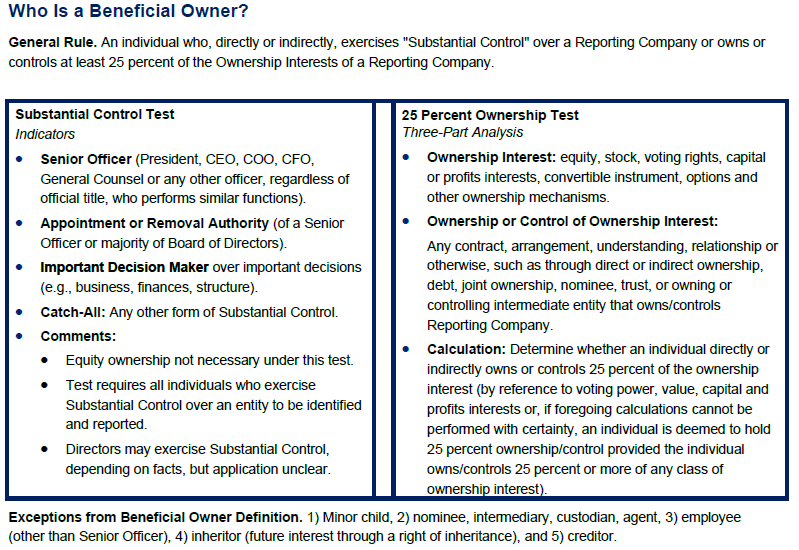

Beneficial Owners Defined

Company Applicants Defined

Definition: A Company Applicant is an individual involved with the formation or registration of a Reporting Company.

- Category 1: The individual who directly filed the document that created a Domestic Reporting Company or that first registered a Foreign Reporting Company with a secretary of state or similar office.

- Category 2: The individual who was primarily responsible for directing or controlling the filing of the creation or registration document, provided more than one individual was involved in the filing.

Comment: A Reporting Company formed on or after Jan. 1, 2024 (but not before) must report at least one Company Applicant and, at most, two.

What are the Reporting Obligations of a Reporting Company to FinCEN?

Reporting Company Created/Registered Before Jan. 1, 2024

Provide information about:

- Itself

- Beneficial Owners

- But not Company Applicants

Reporting Company Created/Registered On or After Jan. 1, 2024

Provide information about:

- Itself

- Beneficial Owners

- Company Applicants

Frequently Asked Questions & Links

FAQ

How to File the BOI for Your Business

Treasury Secretary, Janet Yellen Confirms the Validity of This New Requirement

Our team of dedicated CPAs stand ready to navigate you through the changing terrain of the Corporate Transparency Act, ensuring you are well-informed about every aspect, especially concerning beneficial ownership information reporting. Rest assured, we are committed to providing expert guidance as you navigate this evolving landscape.